Investment readiness

Why does your business need this service?

The first step in seeking external money from investors is to identify the kinds of investors who are appropriate for your company and scenario. You’ll need to organize your affairs, comprehend what particular investors would want to view, and deliver it in a persuasive, clear manner. You will be required to provide details regarding your business model, significant financial data, talent, anticipated terms, and spending plans.

It’s really difficult to raise money through investments. Given how many pitch decks investors of all sizes are likely to see and what you’ll be asking of them, it goes without saying that you must first spend time carefully planning and checking the appropriate items. Additionally, this is about selecting the best partner for your company. When you take a targeted strategy to fundraising, you’ll be able to attract the ideal investors—those whose values are compatible with your own and who will provide you with conditions that support your long-term objectives. de tempête can help you efficiently to find the right investors for you.

Our investment readiness service includes

Business Plan Review and Development

In order to make sure that the business plan successfully conveys the company's value proposition, market opportunity, competitive advantage, and growth strategy, the firm offers expert help.

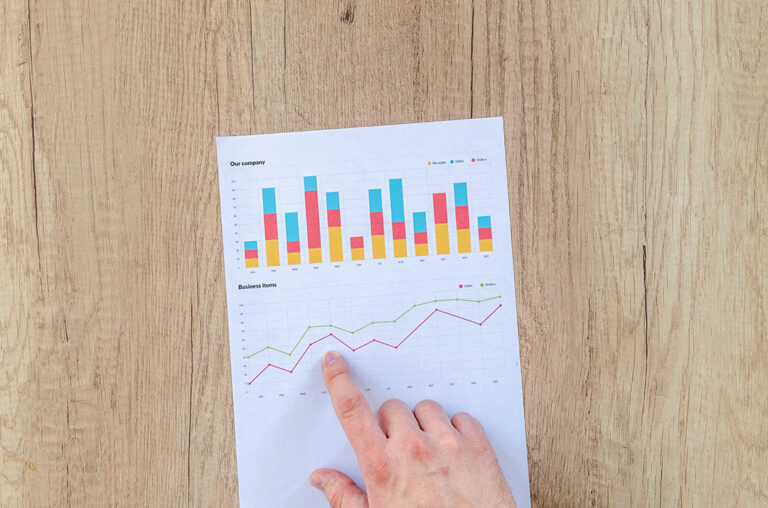

Financial Analysis and Projections

the firm offers assistance in developing precise financial data thorough financial projections, including revenue forecasts, expense estimates, and cash flow analysis to assess the possible returns and risks.

Market Research and Analysis

In-depth market research to understand industry trends, target audience behavior, and the competitive landscape that can assist investors better grasp the position of the business in the market.

Valuation Services

The firm works with businesses to determine its value using a variety of valuation techniques, making sure that the valuation is reasonable and convincing to potential investors.

Legal and Compliance Guidance

Investment readiness services may involve legal professionals who review contracts, intellectual property rights, and other legal aspects of the business.

Pitch Deck Creation

The firms help design visually appealing and content-rich pitch decks that highlight key business aspects and investment opportunities.

Show where the money fits in

In this service, the company will create a financial plan for the next term in order to show the targeted investors the potential return on their investment.

How much a stake is worth

preparing realistic returns that need to be offered to the investor by landing on a valuation and comparison with similar businesses.

Team Evaluation and Enhancement

Services for investment preparedness may include assessing the team's capabilities and making any necessary improvements or additions.

Networking and Investor Introductions

The company may use its network to link companies with possible investors which is helpful for connecting with investors that are involved in the market.

Due Diligence Support

In order to speed up the process and foster investor confidence, the firm assists businesses in putting together the appropriate paperwork while investors do due diligence.

Strategic Advisory

This service provides continuing strategic advice services to organizations, assisting them in honing their growth plans, spotting potential obstacles, and adjusting to shifting market conditions.

Market fit product analysis

Continuous evaluation of the alignment between a product and its target market's needs, preferences, and demands and modify the product as per market demand.